The SME Compass Index assesses that the Serbian SME sector is at a lower intermediate level of development. Competitiveness is evaluated using 75 indicators, which are further aggregated into 9 pillars. Indicators are obtained through a representative annual survey of 1,500 companies.

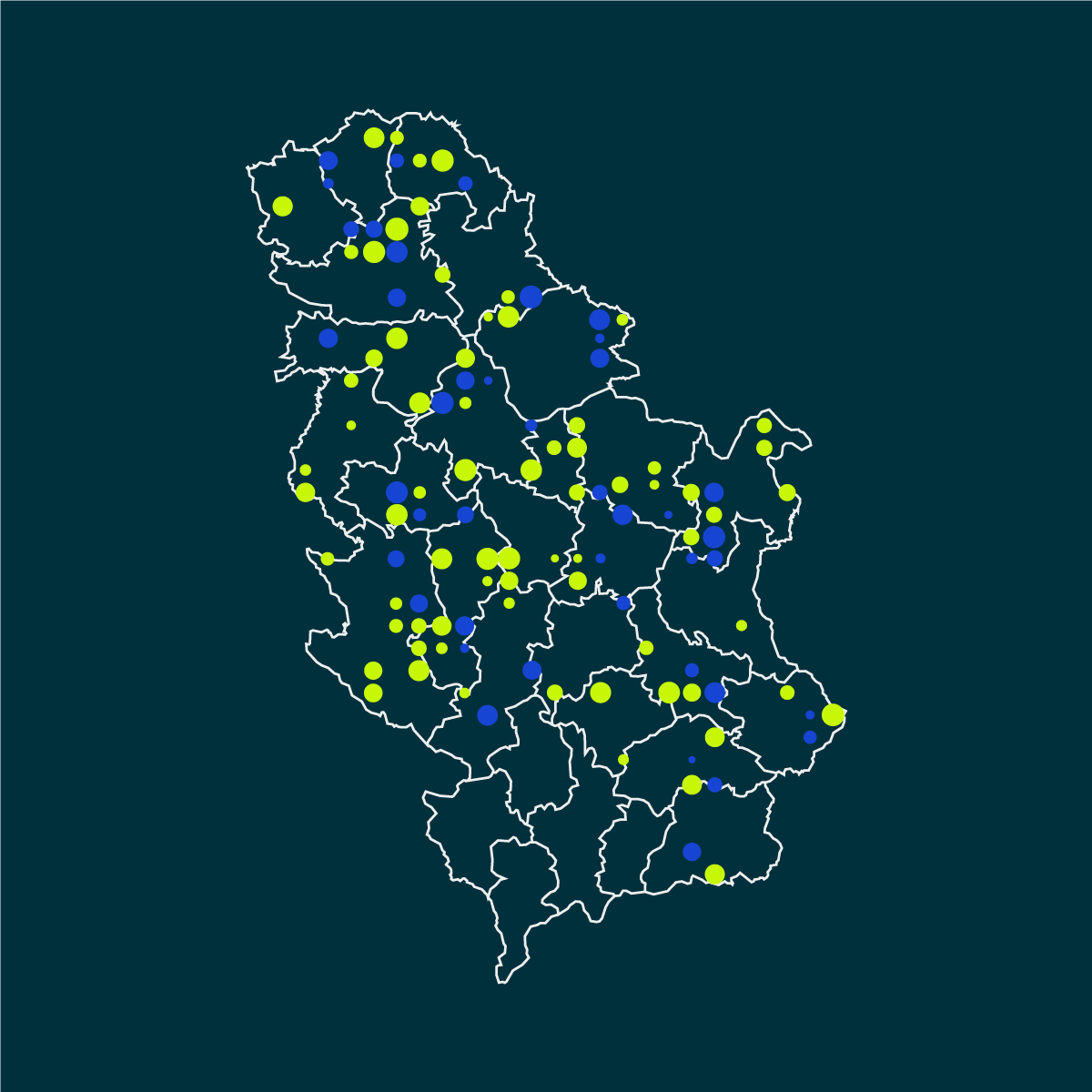

SME Compass is your reliable guide through the domestic economy. It is an interactive portal dedicated to small and medium-sized enterprises. Through a series of specially designed tools and open data, the portal provides a detailed insight into the competitiveness of the sector and the factors influencing it – business results, innovation, digitalization, green transition, financing for growth, and workforce employment. The portal also offers up-to-date and interactive modules for tracking prices, interest rates, export products, jobs, earnings, and business expectations. Users can explore over 17,000 companies through the “Biz Map,” identifying those that meet their key business criteria.

The development of SME Compass is supported by USAID through the “Big Small Businesses” project, implemented by ACDI/VOCA.

Assessment of the competitiveness of the SME sector in nine areas: performance, business environment, business model, human resources, innovation, Industry 4.0, green transition, access to finance, and gender aspect.

Up-to-date and interactive modules for tracking prices, interest rates, export products, jobs and earnings, and business expectations.

Set criteria and find the desired group of companies. Female micro-businesses in Eastern Serbia? Exporters of metal products with 50+ employees in Šumadija? Low-debt companies outside urban areas.

Assessment of the state of the SME sector in 2023

Incentivizing aspects

- Over 95% of companies are focused on or highly satisfied with the technical, soft, and digital skills of their current employees.

- More than 40% of companies with >10 employees export their products to foreign markets; even 85% in the ICT, ‘mid-tech,’ and ‘high-tech’ sectors.

- The lifeblood of the domestic economy (O2) – resilience and optimism. As many as 90% of companies expect to maintain and improve their position in the coming period.

- A flexible approach in which companies continuously adapt their products to the needs and demands of customers.

Constraining factors

- As much as 90% of companies cite the key constraint to growth as the challenge of finding new talent and retaining existing staff.

- +Outdated management models and inadequate access to capital.

- = Significant underinvestment (MSP investments are only 50% of those in the EU).

- Only one in eight MSPs significantly expanded capacity in the past three years. The majority of companies have yet to take even initial steps in the fields of digital transformation and green transition.

Detailed results, categorized by sectors, regions, and company sizes, are available in an interactive format on the MSPKompas.rs